When it comes to planning for the long run, everyday living insurance coverage remedies will often be the very first thing men and women give thought to. They offer a way of protection and reassurance, understanding that the family and friends will be economically secured just in case the unexpected comes about. But existence coverage generally is a challenging principle to grasp, specially when you're bombarded with so many various insurance policies and phrases. So, how Did you know which daily life coverage Answer is right for you?

Enable’s split it down. Daily life coverage comes in lots of types, Each individual built to meet various requires and money aims. No matter if you’re looking for something straightforward and inexpensive, or a more comprehensive plan that builds money value as time passes, there’s a everyday living insurance policy solution customized just for you. But in advance of we dive in to the specifics, it’s vital to be familiar with the purpose of lifetime insurance. It’s not just a fiscal security Internet; it’s a method to make certain that your family can keep on to prosper, even when you are now not all around.

Affordable Insurance Solutions Fundamentals Explained

Step one in Discovering life insurance policies answers is to know the differing types of coverage accessible. The 2 main groups are expression lifestyle insurance policies and long lasting lifetime insurance. Time period existence insurance offers protection for a specific time period, usually 10, twenty, or 30 decades. It’s commonly extra cost-effective than permanent lifestyle insurance coverage, making it a popular option for young households or persons with a budget. However, as soon as the phrase expires, the protection finishes, meaning it’s not a choice If you'd like lifelong security.

Step one in Discovering life insurance policies answers is to know the differing types of coverage accessible. The 2 main groups are expression lifestyle insurance policies and long lasting lifetime insurance. Time period existence insurance offers protection for a specific time period, usually 10, twenty, or 30 decades. It’s commonly extra cost-effective than permanent lifestyle insurance coverage, making it a popular option for young households or persons with a budget. However, as soon as the phrase expires, the protection finishes, meaning it’s not a choice If you'd like lifelong security.On the other hand, long-lasting everyday living insurance policy alternatives last your total lifetime, provided that premiums are paid out. In just permanent lifestyle insurance, there are actually diverse versions, which include whole lifetime, common life, and variable everyday living insurance plan. Just about every of such has its exclusive functions, including hard cash value accumulation, adaptable premiums, and investment alternatives. Complete everyday living insurance coverage, one example is, offers a fastened top quality as well as a guaranteed Loss of life reward, offering equally defense in addition to a financial savings ingredient that grows eventually.

Now, let us discuss the significance of getting the ideal lifestyle insurance coverage Resolution for your own problem. When choosing a plan, it’s vital to think about your monetary ambitions, spouse and children framework, and long term wants. Do you need your beneficiaries to receive a large payout, or would you prefer a plan which can serve as a economic asset in the future? The solution to these questions will help guideline you toward the correct policy. It’s also important to evaluate your finances—some insurance policies are more reasonably priced than others, and also you’ll need to make sure the top quality suits comfortably inside of your economic program.

One of the most important areas of lifetime insurance answers is their capability to present monetary security for the family members. If a little something have been to occur for you, your plan would pay out out a death reward that will help cover funeral charges, exceptional debts, and residing fees. But lifestyle insurance could also serve other uses outside of defending All your family members’s monetary upcoming. As an example, some life insurance coverage answers give residing Advantages, which let you obtain your coverage’s money price while you're still alive in case of a terminal health issues or other emergencies.

Another component to think about When selecting a life insurance policies solution is your age and wellness. The youthful and much healthier you will be when you purchase a policy, the decreased your premiums are likely to be. When you hold out until finally you happen to be more mature or going through medical issues, your rates may be significantly greater, or you might be denied coverage entirely. This really is why it’s crucial to program ahead and check out your choices Whilst you're in very good wellbeing.

Lifetime insurance could also Participate in a critical job in estate arranging. In case you have property that you might want to go on to the beneficiaries, a existence insurance policy policy can help offer the necessary liquidity to cover estate taxes, guaranteeing that the family members aren’t burdened with a significant tax Invoice after you move away. By strategically incorporating lifestyle insurance policies into your estate plan, you are able to make a more productive and cost-helpful technique to transfer wealth.

Let’s also speak about the flexibleness of daily life insurance policies methods. In right now’s entire world, our requires are continually switching. That’s why some everlasting life coverage insurance policies, like universal daily life, supply flexibility with regards to premiums and Dying Rewards. With common life insurance coverage, you may alter your coverage as your circumstances evolve, which makes it an outstanding choice for individuals whose financial problem may perhaps fluctuate after a while. This flexibility is especially useful for individuals who want to ensure their coverage stays consistent with their desires.

Are you someone that likes to consider an active role in controlling your investments? If that's so, variable existence insurance is likely to be the correct choice for you. With variable life insurance policy, you are able to allocate a percentage of your premiums into several different expenditure choices, for instance stocks, bonds, or mutual cash. This can offer the potential for better dollars benefit accumulation, but What's more, it comes with more threat. So, in the event you’re snug with the idea of current market fluctuations and want to be more involved with your coverage’s development, variable daily life insurance policies may be a very good healthy.

Of course, no lifestyle insurance plan Option is without having its negatives. Phrase lifestyle insurance coverage, whilst economical, doesn’t give any money benefit or investment possible. After the time period finishes, you may have to invest in a new coverage, typically at an increased rate. Everlasting daily life insurance policy methods, on the other hand, may be more expensive and will not be essential for All people. It’s essential to weigh the advantages and disadvantages of each and every choice prior to making a choice.

When buying life coverage, it’s also crucial to consider the popularity and fiscal balance of your insurance company. You desire to make sure that the corporation you decide on is economically robust and it has a history of spending statements immediately. In any case, the whole place of life insurance plan is to deliver comfort, this means you’ll want to select a service provider you'll be able to have confidence in to provide on their own guarantees.

The Buzz on Tailored Insurance Solutions

Although life insurance is An important A part of many people’s monetary organizing, it’s not the only real Resolution. You will find other strategies to shield Your loved ones and Make prosperity, such as investing in retirement accounts, savings programs, and other sorts of coverage. Everyday living insurance must be seen as just one piece of a broader money system that can help you accomplish your lengthy-time period ambitions and safeguard your family members.But Permit’s not ignore the emotional advantages of lifetime insurance plan. Realizing that your family will be looked after financially can bring satisfaction, especially if you’re the key breadwinner. Life insurance coverage offers a security Internet, making certain that your family and friends don’t must wrestle economically immediately after your passing. It’s a present that See more retains on offering, long When you’re absent.

Rumored Buzz on Comprehensive Insurance Solutions

It’s also really worth noting that existence insurance alternatives could be Full story a useful Instrument for business people. Should you personal a company and need to ensure its continuity following your death, lifetime insurance policy can provide the mandatory resources to purchase out your share from the enterprise or to address any monetary obligations. Occasionally, existence insurance plan may even be used for a funding resource for your acquire-market settlement, helping to shield your small business partners and protected the way forward for your company.

In case you’re Not sure about in which to begin With regards to selecting a existence insurance Answer, look at dealing with a fiscal advisor or insurance coverage agent. They will let you navigate the several selections obtainable and make sure you’re creating an informed decision depending on your exclusive predicament. A specialist also can make it easier to fully grasp the fantastic print of each plan, and that means you’re crystal clear on what’s involved and what’s not.

In Understand more summary, existence insurance plan alternatives are A vital element of the strong financial prepare. No matter if you decide on expression everyday living or long lasting existence insurance policy, the goal is identical: to shield your loved ones and supply money stability when they have to have it most. By comprehending your options and choosing the ideal policy for your needs, you are able to make sure Your loved ones is nicely looked after, regardless of what the longer term holds. So, make time to explore your choices and look for a lifetime insurance plan Remedy that actually works in your case. Your family and friends will thank you for it.

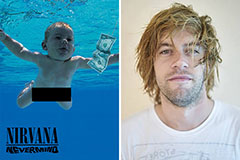

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!